I love this question because it evokes such interesting related questions. The starting point question -- how big a market is required for a specialist -- is well worth answering, but it quickly leads to a deeper and more evocative question: What does it mean to you to know that the market is "big enough"?

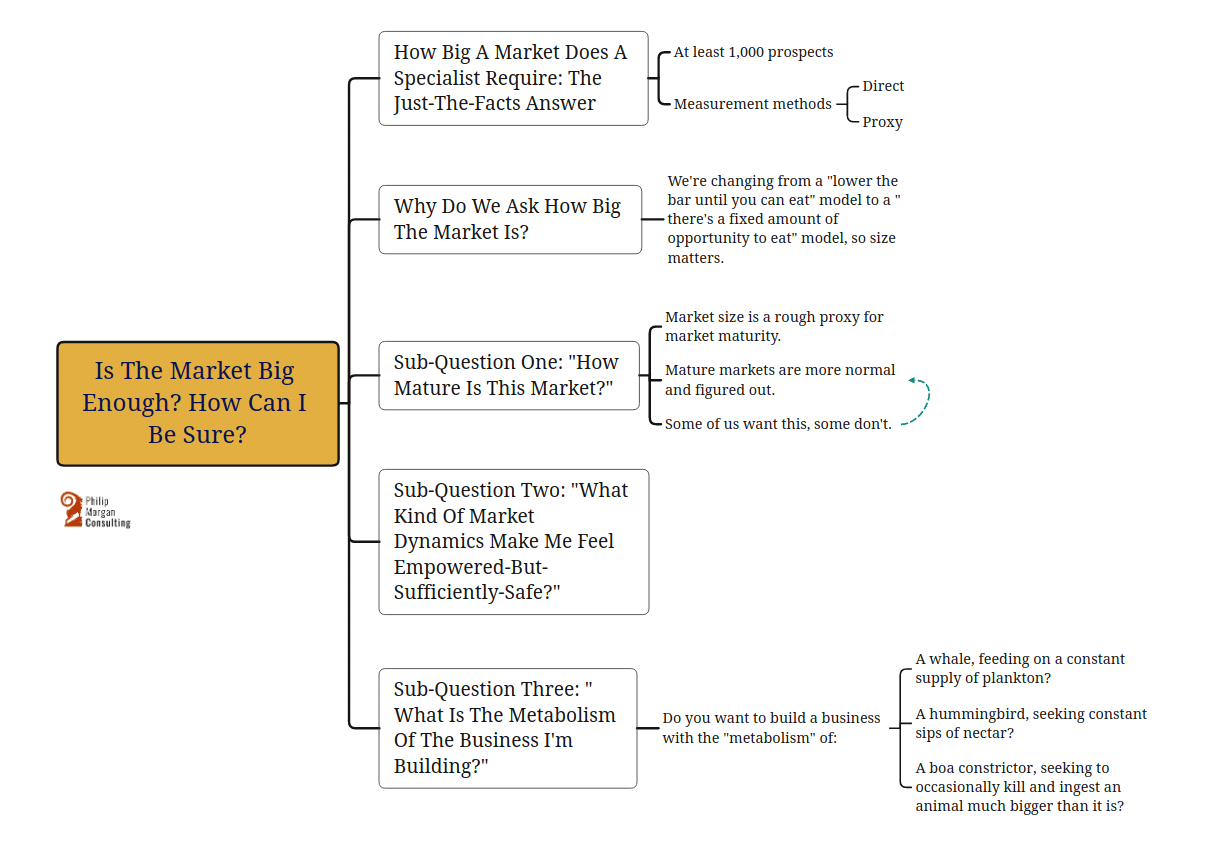

How Big A Market Does A Specialist Require: The Just-The-Facts Answer #

I trust David C. Baker's numbers here: https://www.davidcbaker.com/how-man-competitors-and-prospects-should-you-have. David recommends a minimum market size of 2,000 prospective clients. For soloists I'm comfortable with a lower limit of 1,000 prospects.

How do you measure the size of a market? Talk to every single buyer in the market and ask them if they might ever need a specialized consultant like you. Simple!

I joke very intentionally about using a ridiculously high-effort measurement method to shock you into accepting that you can't know for sure how big any market is, but you can reduce your uncertainty enough to allow you to move forward with confidence. Knowing for sure requires unrealistic amounts of measurement effort. Reducing uncertainty enough to move forward with confidence requires using one or more of these:

- Direct measurement methods:

- Use LinkedIn Sales Navigator to perform an account search for prospective clients. Easy if you're considering a vertical specialization; not easy if you're considering a horizontal specialization. Exclude companies too big to take you seriously and too small to afford you.

- If you're selling to the US market, use https://data.census.gov/cedsci/ to get numbers to sanity-check against what you find with LinkedIn.

- Proxy measurement methods:

- Look for existing competitors. Competitors are not people trying to take opportunity away from you; they are evidence that clients are already buying the thing they sell. As per David Baker's numbers, look for at least 10 competitors. As per my recommendation, email these competitors and ask if you can talk to them about how it's going for them. About 50% will say yes and you'll learn a ton.

- Look for "ecosystems of support". These are industry associations, conferences, or communities that support the market you are trying to measure the size of. If there are no ecosystems of support, the market may not be big or mature enough.

If you are considering a horizontal specialization and you want to know if the market is big enough to support your business, then the proxy measurements are the only methods available to you. Don't worry, they yield plenty of uncertainty-reduction.

Why Do We Ask How Big The Market Is? #

There are good primary and secondary reasons for asking.

The primary reason for asking: specialization is unfamiliar to us, so we're rightly curious. Market size, and how big a market size is needed seem like critical facts, and indeed they are.

When we move from generalist to specialist, we already understand how to generate more opportunity within the generalist model: talk to more people and become more flexible about what kind of work you'll pursue and accept. For a generalist, the market can't be too small because you can always lower your standards to enlarge the market. An analogy: you like high quality organic food, prepared using healthy home cooking methods, but when you get hungry, yeah, you'll eat low-quality junk food from a roadside fry pit.

When we specialize, the model changes from the market is anyone you can get a sales conversation with to the market is limited to your defined target market, and so we start to wonder a lot about whether there's sufficient opportunity within the fixed size of that target market. Analogy: You've become a celiac and there are now real and immediate consequences to eating the wrong stuff, so you'd like to really understand the much smaller "market" of food you are able to eat.[1]

The secondary reasons for asking the "how big" question have to do with issues of identity and confidence and our relationship to risk (risk = uncertainty + potential for gain/harm). These secondary reasons lead to 3 sub-questions.

Sub-Question One: "How Mature Is This Market?" #

"How mature?" is a question that's connected to the "how big?" question. I don't hear the sub-question voiced very often, but it's there, and it's there because it really does matter.

Mature markets are more normal and figured out. It's somewhat obvious what produces value and how to monetize that value. There are norms, benchmarks, and best practices to align with. There are people who can help you if you get stuck because they've seen how others get unstuck from that particular place and seen the patterns that produce both stuckness and the relief of stuckness. There are competitors to both aspire to be like and to try to not be like.

You'll notice that the proxy measurements for market size are also direct measurements for market maturity. Executing the measurement (counting and assessing the quality of competitors, for example) generates insight about how mature the market is.

For some folks, every "benefit" of a mature market is actually a reason to avoid that market. The abundance of best practice is an indicator of looming boredom. They want to figure these things out themselves! They are adventurers.

So not everyone wants a mature market, but many do, and answering the question about market size helps these folks get clear about whether it's a mature market they'll feel comfortable specializing in.

Sub-Question Two: "What Kind Of Market Dynamics Make Me Feel Empowered-But-Sufficiently-Safe?" #

I've lived in 28 different houses in 5 states and 1 US territory. 5 of those were before I had any control over where I lived, but that still leaves me with a record of 23 voluntary moves. I'm clearly more comfortable with moving house than the Average American, who averages 11.7 lifetime moves.

I seem to be settling down but even at age 47 I still feel more comfortable if I believe that I've got a major relocation coming up in a few years -- merely maintaining that belief in my mind calms me and keeps me from feeling stuck. This is my empowered-but-safe happy place.

When it comes to a target market, I think many of us have similar psychological needs; we want to feel empowered-but-safe, or empowered-but-sufficiently-safe. What kind of market creates this for us?

Is it:

- No peers/comparables but significant opportunity?

- No peers/comparables, but we believe that we can participate in creating and subsequently own much of the future opportunity?

- Lots of comparables, which allows us to believe that what we're doing is broadly recognized as valuable?

The first two answers to the "happy place" question indicate an entrepreneurial drive and confidence. Translation: this kind of person is less likely to fret about small market size in the first place, but if they do ask about market size, the question comes from a somewhat mercenary effort to accurately and deeply understand the frontier where they are building an outpost. The latter formulation of the question is indicative of a different "happy place".

In metaphorical terms, this sub-question is a teenager asking, "so who did you say is going to be at this party?"

Sub-Question Three: "What Is The Metabolism Of The Business I'm Building?" #

Do you want to build a business with the "metabolism" of:

- A whale, feeding on a constant supply of plankton?

- A hummingbird, seeking constant sips of nectar?

- A boa constrictor, seeking to occasionally kill and ingest an animal much bigger than it is?

I don't know that there's a corpus of good knowledge or research to guide us here, so let's rely instead on a sort of felt heuristic: whales and boa constrictors need a larger more mature market, while hummingbird businesses are more suited to smaller or less mature markets.

I realize that at some point, this analogy falls apart. Whales, boas, and humminbirds all move around in search of food, while many of us want the food to come to us! Still, the idea of a "business metabolism" is relevant, and it's worth it to think deeply about the kind of business metabolism you want to design and the dynamics of the market you will specialize in. Timebox this thinking lest it trap you in analysis paralysis. Remember the very normal human tendency to overestimate risk in novel situations. But do think and be intentional about seeking a match between your target market and your desired business metabolism.

Concluding Thoughts #

Finally, do realize that if you find yourself asking about quantitative market size on the small end ("Is it big enough?"), you might really be seeking answers to these 3 more qualitative questions about market maturity, your happy place, and your business metabolism.

These 3 sub-questions are connected. Your business metabolism constrains the markets where you can find a happy place. Your preferences about happy place will have consequential implications about market maturity. So the 3 sub-questions are not a decision tree or a flowchart, but rather an exercise in building a "3-legged stool" where the legs are well-balanced enough that it's a comfortable, functional stool.

I hope that this article has been helpful. If you’re looking for more context and detail on specialization and positioning, then read my free guide to specialization for indie consultants.

Notes:

[1]: This model, which sees a specialized market as containing opportunity that is limited by the number of buyers in the market, is only partially correct. A more complete model would reflect an always-growing ability to recognize and monetize ever more opportunity from the same group of prospects as your expertise grows. Said differently, when you first specialize, your opportunity is constrained to the size of the market you specialize in, but as your specialization yields deeper and deeper expertise, new kinds of revenue opportunities become available to you, which effectively increases the size of the market over time. Specialized markets really are "bigger on the inside".